Banks' image brightens with customers

Customer satisfaction with retail banks in China has improved this year due to the industry's efforts in creating transparency, according to a survey released by JD Power Asia Pacific Inc on Monday.

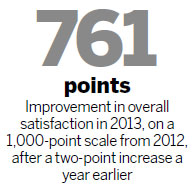

Overall satisfaction in 2013 improved by 74 points to 761 on a 1,000-point scale from 2012, after having experienced a two-point increase one year earlier, the company said.

"The dramatic improvement in customer satisfaction is attributed to the concerted efforts across the industry in creating transparency and improving the customer experience," said Steven Zou, director of financial services at the company.

He said closer scrutiny by the China Banking Regulatory Commission of banks' business transparency in 2012 effectively helped banks standardize their processes in dealing with customers.

Improvement in facilities, product offerings, account information, transactions and problem resolution contributed to the overall increase in satisfaction, Zou said.

Overall satisfaction among retail banking customers in China who use self-service channels stood at 786 points, 51 points higher than among those who do not use such channels.

Satisfaction with large commercial banks increased 76 points from 2012, while satisfaction with joint-stock banks rose 61 points, said the company.

The survey covered 9,267 retail-banking customers in 20 cities, and involved the operations of 21 banks.

China Everbright Bank Co ranked the highest in customer satisfaction, followed by China Minsheng Banking Corp and Shanghai Pudong Development Bank Co Ltd.

Bank of Communications Ltd ranked highest among the State-owned commercial lenders with 787 points. It was also the most improved bank in the survey.

The survey measures customer satisfaction regarding transactions, product offerings, account information, accommodations, fees, and problem resolution.

"As for what types of problems customers experienced in the past 12 months, lower satisfaction came from longer waiting times, lack of notification about fees or bad service," Zou said.

"China has clearly moved a long way in delivering superior customer satisfaction with retail banking services," said Rockwell Clancy, vice-president of global financial services at JD Power.

"Yet there is still a tremendous opportunity for competitors to differentiate themselves in bringing greater uniformity to processes and practices that affect customers, being absolutely transparent about the pricing and risks of their products, and resolving customer complaints more effectively."

The survey showed 29 percent of customers said they were not adequately notified of new product risks, while 39 percent said they did not receive notification about fees.