A glance at the ships traveling to and from the Shanghai International Port makes it clear that the city is approaching its goal of growing into a global shipping hub by 2015.

A 2009 State Council report that included guidance for establishing an international financial and shipping center in Shanghai gave the local government substantial support to help the city realize its industrial transformation.

The municipal government also came up with a plan to advance the process, by gathering important shipping and resources elements and establishing a comprehensive shipping-service system.

In June 2011, the Shanghai Shipping Exchange came out with an export-container freight-derivative deal based on the exchange's freight index, with which shipping companies can discover prices in advance and avoid price risks.

The municipal government also recently introduced a tax-refund policy at the port of departure, which went into effect on Aug 1.

The policy applies to container goods that clear customs in Qingdao or Wuhan, carried by Shanghai Puhai Shipping Co Ltd or Sinotrans Hubei International Trade Co Ltd, and depart Shanghai directly via waterways.

"With this policy, companies that need to export goods can get tax refunds at the place from which they depart, which will save a lot of time and trouble. Before this policy was implemented, many Chinese companies chose the port of Busan in South Korea," said Zhen Hong, secretary-general of the Shanghai International Shipping Institute.

Although the Chinese domestic shipping industry is expanding rapidly, with an annual growth of 38 percent last year, international goods made up just 5 percent of shipping at Shanghai International Port.

"The introduction of this tax-refund policy will attract more companies to transit in Shanghai and thus help the city further its goal of becoming an international shipping center," Zhen said.

The city's goals of financial and shipping development have combined via the introduction of many forms of shipping insurance.

Zurich Insurance Group, working with Shanghai's Pudong New Area, has established a shipping and financial research center, while Chartis Insurance is offering several creative insurance products such as port-and-quay and logistics-manager comprehensive insurance.

Meanwhile, China Pacific Insurance and People's Insurance have set up their shipping insurance operation centers in Shanghai, while the Ping An Property and Casualty Insurance joined their ranks on Aug 1.

"Ping An will be dedicated to strengthening cooperation with shipping organizations and companies, cargo agents and professional insurance agents, and will also provide more varieties of better shipping insurance services," said CEO Sun Jianping.

"Shipping-insurance premiums in China amounted to 2.8 billion yuan ($440 million) last year, up about 10 percent year-on-year. There were at least 39 companies offering shipping-insurance services by the end of 2011. The huge demand has resulted in the rapid growth of the shipping insurance market.

"What needs to be done at present is to provide more varieties of insurance and increase the insurance sales force," said Zhen.

However, the Shanghai government's shipping-hub ambitions had met with unprecedented economic setbacks in recent years. According to the latest Shanghai International Shipping Institute report, the prosperity index of the Chinese shipping industry was a mere 87.64, not as strong as previously hoped.

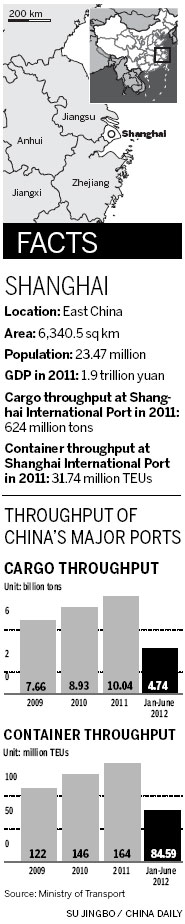

Chinese ports with a minimum coastal-cargo throughput of 15 million metric tons and a minimum inland-waterway cargo throughput of 10 million tons reached 4.74 billion tons of cargo throughput in the first half of this year, up about 7.2 percent year-on-year. However, the growth rate decelerated by 6.1 percentage points year-on-year.

These ports reached an exported-cargo throughput of 1.52 billion tons in the first six months, up about 13.6 percent year-on-year; the growth rate increased by 5.5 percentage points. Domestic-cargo throughput reached 3.23 billion tons, up by 4.4 percent, while the growth rate for this sector went down by 11.3 percentage points.

The container throughput of these ports reached 84.59 million 20-foot equivalent units (TEUs) in the first half of the year, up by 8.8 percent, but down 4.3 percent year-on-year in terms of growth rate.

"The decrease in ports' cargo throughput growth can be largely attributed to the present economic downturn. It is also in line with the sloppy shipping industry nowadays," said He Jianzhong, a Ministry of Transport spokesman.

But companies should not be disheartened. As Zhen said, fluctuations in the shipping industry take place from time to time.

"Shipping companies can weather the hard times by raising their freight rates. Crises usually end earlier for the shipping industry. Therefore, shipbuilders have to invest right now," he said.

The target that Shanghai set for itself has also energized neighboring provinces including Jiangsu and Zhejiang, both of which enjoy abundant port resources.

"As soon as the ports of different provinces are connected, regional barriers can be removed. But the first thing the ports of Jiangsu and Zhejiang should do is to have a clear direction. The question is whether they should be serving the goals of Shanghai or finding their own positions, otherwise resources may be wasted," said Zhen.

The cargo throughput of Shanghai International Port reached 443 million tons in 2005, overtaking Singapore to become the busiest port in the world. The port maintained its momentum, with cargo throughput soaring to 720 million tons by the end of 2011. Likewise, its container throughput amounted to more than 31.73 million TEU in 2011, the most in the world in terms of volume for the second consecutive year.

However, when international shipping giants march into the Asian market to establish offices or branches, their first priority remains Singapore rather than Shanghai.

"This has bewildered us for a long time. It is true that we are lagging behind Singapore in terms of the modern shipping-service industry. Singapore also enjoys a close relationship with the European shipping giants, especially the British ones in terms of culture, language and legal systems. But it is up to us to think of our advantages and what we can do to catch up and even take over in the near future," said Zhen.

Shanghai also lags far behind London in terms of decision rights, he said.

"The city is still working hard to build a high-end shipping service system. But, more importantly, we should have more decision rights. Take shipping insurance as an example. Before the concept fully swung into the current form of shipping insurance, people had been following British rituals, ruling out all responsibility," Zhen said.

"Nowadays, international shipping rules are decided elsewhere. The development trend is not found in Shanghai, nor are the indices that affect freight rates. If we are really determined to become an international shipping hub, these are the goals we have to accomplish."

shijing@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions