|

|

|

A worker raising a national flag at the Haiyangshiyou 981 oil rig. China, as the world's second largest oil consumer, is accelerating its pace of exploring for oil and gas in deepwater areas in the South China Sea. [Photo / China Daily]? |

China National Offshore Oil Corp has kept its head down since last June's oil spill but it made a rare high-profile debut this May with the country's first homemade deepwater drilling rig, underscoring that it is gearing up for further deepwater exploration in the South China Sea.

However, it is unclear how ambitious the country's biggest marine oil producer is about tapping into the deepwater sector, whether at home or abroad, because it has yet to unveil a detailed blueprint on its plans as State-owned companies usually do for the current five-year plan period (2011-2015) and the next five years.

Wang Yilin, chairman of CNOOC, set a target to double the company's oil and gas output to 120 million tons of oil-equivalent by the end of 2020 from 2010's level, without giving details for the deepwater output.

The target also sent a signal that a plan to create a "deepwater Daqing", or having annual production of 50 million tons of oil-equivalent, by 2020, as mapped out by Wang's predecessor Fu Chengyu, was sidelined. Daqing is the largest oil field in the country, located in Northeast China's Heilongjiang province.

On May 9, CNOOC's semi-submersible deepwater rig, or Haiyangshiyou 981, officially drilled its maiden well in the South China Sea's Liwan 6-1-1, located in an area 320 kilometers southeast of Hong Kong with a water depth of 1,500 meters. The high-specification platform is capable of operating at a water depth of 3,000 meters.

Before that, most of CNOOC's domestic oil and gas exploration was limited to a depth of about 300 meters, a benchmark line to separate shallow water from deep water.

The South China Sea, which is estimated to have about 16 trillion cubic meters of natural gas and about 30 billion tons of oil, makes up one third of China's total oil and gas resources.

"The area is expected to be the world's fourth biggest deepwater area for oil and gas exploration, following the Gulf of Mexico, West Africa and Brazil," said Zhou Shouwei, an academic at the Chinese Academy of Engineering.

Most of China's deepwater oil and gas reserves are located at a water depth of 3,000 meters, Zhou said.

As such, CNOOC, with no better options in other domestic areas, has pinpointed the South China Sea as the most important area for deepwater exploration.

China's ever-growing appetite for oil and gas to support its economic expansion amid heavier-than-ever dependence on foreign oil imports also makes the domestic deepwater exploration attempts a must, said Yuan Guangyu, CNOOC's assistant president. More than 56.3 percent of China's crude oil consumption and 21.9 percent of domestic natural gas was imported in 2011, he said.

However, the company's de facto development in the area is lackluster if compared with the dazzling prospects it has depicted.

CNOOC has yet to see any commercial production in the deepwater area since the first domestic deepwater discovery Liwan 3-1 was made by Husky Energy Inc in 2006. Another two discoveries, Liuhua 34-2 and Liuhua 29-1,were made in 2009 and 2010 respectively, also by Husky.

"The successful (latest) discovery and appraisal of Liuhua 29-1 not only inspired our deepwater exploratory activities in the South China Sea but also deepened our understanding of the geological structure in the area," said CNOOC Ltd, an upstream-focused subsidiary of CNOOC, in a note, Form 20-F, to the United States Securities and Exchange Commission.

The Beijing-based CNOOC Ltd is dually listed in Hong Kong and New York.

Commercial production of several billion cubic meters of natural gas is set to start at the Liwan 3-1 field next year.

All the three discoveries are gas fields located in the Baiyun Sag, a 20,000 square kilometer area that is estimated to have about 700 million metric tons of crude and 1.2 trillion cubic meters of gas, making it the major target for the semi-submersible platform to drill wells this year.

However, there is no timetable for the upcoming drillings publicly available.

Even from the less challenging waters below 300 meters in the South China Sea, CNOOC's performance in the past two years still seems far from impressive.

According to the annual report from CNOOC Ltd this year, production of crude oil and liquids in the South China Sea, including both the western and southern parts, were down 6.3 percent year-on-year to total 70.3 million barrels of oil.

The drop was deeper than the 0.8 percent oil and liquids production retreat in the Bohai area, where operations were suspended at one of the biggest oil fields, Penglai 19-3, last September by the central government after two oil spill incidents last June that leaked more than 700 barrels of crude oil into the sea.

Meanwhile, natural gas production rose 11.1 percent from 2010 in the South China Sea, slightly lower than the company's total natural gas output growth of 11.6 percent. Overseas gas output gained by12.6 percent in the same period.

CNOOC Ltd is targeting a net production of between 330 and 340 million barrels of oil-equivalent in 2012, about the same as the 331.8 million barrels of oil-equivalent reached last year.

The company's Chief Financial Officer Zhong Hua said the Bohai area will remain its major growth engine in the near term. Five new offshore discoveries were made in Bohai in the first quarter of this year, including the mid- to large-sized Kenli 2-1 and the large-sized Penglai 9-1, he said, without revealing reserve volumes.

"It may take at least 10 years to create large-scale deepwater production for our company," said a senior official from CNOOC who declined to be named. The source didn't elaborate on how big the volume should be to become "large-scale production".

Another official who is mainly engaged into the operations of CNOOC's eastern South China Sea area, said it is set to produce 10 billion cubic meters of natural gas by the end of 2015 and 15 billion cubic meters by 2020.

Figures from CNOOC show that it realized 57.6 billion cubic feet (1.63 billion cubic meters) of natural gas output in the eastern South China Sea last year. In other words, the goal for 2015 is more than six times higher than the level made in 2011.

"It's a very challenging task," the official admitted, even though the company's deepwater technological outfit, led by the Haiyangshiyou 981, makes CNOOC capable of conducting exploration in the deepwater area. "Deepwater exploration is so sophisticated with lots of uncertainties," he added.

However, given the limited discovery of oil in the South China Sea, natural gas will still be the major contributor to CNOOC's deepwater output based on current discoveries. This scenario cannot be changed until more oil discoveries are made, the official said.

"Asian company portfolio value remains heavily inclined toward maturing conventional assets and, despite recent progress, they are under-exposed to international growth resource themes such as oil sands, unconventionals, LNG (liquefied natural gas) and deepwater assets. They remain underweight in net present value terms and have weaker production growth prospects compared with international majors in these areas," said Norman Valentine, senior corporate analyst for Wood Mackenzie, a global energy research and consultancy group.

Wood Mackenzie estimated that conventional assets in Asia currently make up 70 percent of Asian company portfolios and will still make up 60 percent of their portfolio value by 2017.

According to Peng Qiming, director of the Ministry of Land and Resources' geological exploration department, among the country's top five oil and gas production bases by the end of 2015, each of which is capable of producing 50 million tons of oil-equivalent a year, four are from land areas and the only offshore base is from shallow waters.

But Peng touched on the deepwater area by saying that the Pearl River Mouth Basin, which contains the Baiyun Sag and Liwan Sag, is among the major focuses for deepwater exploration within five years.

The government gives CNOOC more leeway when determining its development pace in the deepwater area, making the State-owned company shift to a more cautious and stable approach when entering more sophisticated areas.

Slowing economic growth in China, which rose by 8.1 percent in the first quarter from the previous year, the slowest since the spring of 2009, may also give the company a brief respite from production hikes in anticipation of slower growth in oil and gas consumption.

The world's second biggest oil consumer saw its crude imports up 3.3 percent in April from the previous year to 5.44 million barrels a day, a significant dive from the 8.7 percent year-on-year increase in March, figures from China's customs authority showed.

In a broader picture, China's growth in energy demand is expected to plunge to 1.9 percent a year within the period of 2021 to 2030 from the average annual increase of 9 percent in the decade ending 2010, as economic growth contracts and energy efficiency improves, according to Christof Ruehl, BP's chief economist.

The current economic scenario will give CNOOC more time to adjust its deepwater drilling rig and related equipment as well as to get its staff more familiarized with the operations, analysts said.

Oil and gas resources are rich in the deepwater South China Sea and are one of the main sources for the company's medium- and long-term development, said Zhu Weilin, executive vice-president of CNOOC Ltd.

"We will move forward in deepwater through our independent exploration as well as through cooperation with foreign companies," CNOOC's Chairman Wang Yilin said.

So far, the company has joined hands with international oil giants including Husky, BP Plc, Anadarko Petroleum Corp and Eni B.V. to explore deepwater resources in the South China Sea.

In addition, CNOOC and its other State-owned oil peers in China have tapped into the international market for the purpose of gaining resources as well as to gain advanced technological expertise for deepwater exploration.

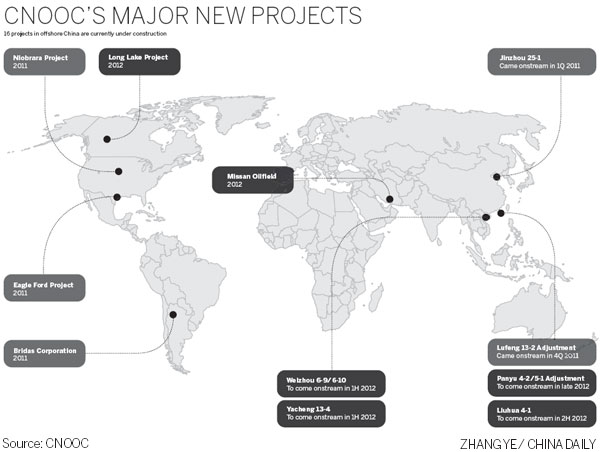

CNOOC now owns equities in deepwater blocks in Canada, the United States and Uganda via mergers and acquisitions.

"While the likes of Sinopec Group and CNOOC Ltd have increased their exposure to deepwater exploration, Asian companies are generally under-represented in many proven deepwater plays such as the Gulf of Mexico, West Africa, Australia and Egypt," said Valentine of Wood Mackenzie. "This reflects their relatively early stage of internationalization and tendency for risk-aversion. Many have not yet accessed high impact but high cost and technically challenging exploration provinces to the same extent as their international peers."

Asian companies will need to enhance their technical and operational capabilities in project development to increase long-term production, he added. "With strong financial capabilities, they are well positioned to next develop working partnerships with resource-holding NOCs (national oil companies) and international oil companies. For many Asian companies, the internationalization story of the last few years may just be the beginning."

zhouyan@chinadaily.com.cn