Inflation expectations on the rise: PBOC survey

Updated: 2011-09-16 09:01

By Wang Xiaotian (China Daily)

|

|||||||||||

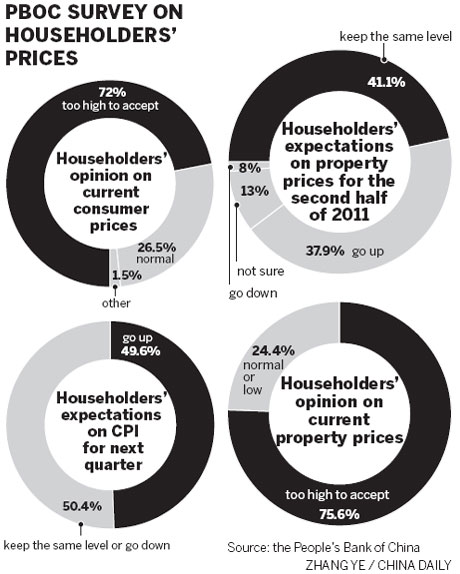

BEIJING - Inflation expectations among Chinese households for the next quarter have risen, despite an August decline in the year-on-year growth of the country's consumer price index (CPI), a main gauge of inflation. That's according to a central bank survey released on Thursday.

| |||

Meanwhile, the PBOC also believes that the current liquidity levels are "appropriate" given the still rapid loan growth and the overall scale of financing.

The proportion of householders who believe that prices generally are "too high to accept" jumped to 72 percent from 68.2 percent in the previous quarter.

Meanwhile, the proportion of those who complained that property prices are too high rose 1.3 percentage points to a record 75.6 percent.

China's CPI rose 6.2 percent year-on-year in August, down from a 37-month high of 6.5 percent in July. But on a monthly basis, the August CPI was still 0.3 percent higher than the July figure, according to the National Bureau of Statistics.

China' new-yuan lending reached 548.5 billion yuan ($85.8 billion) in August, up by 9.3 billion yuan from a year earlier, and 55.9 billion yuan higher than in July.

To soak up liquidity and curb inflation, the government has raised benchmark interest rates three times and increased reserve requirements for commercial lenders six times since the start of the year.

On Wednesday, the Asian Development Bank (ADB) said that inflation remains a concern for the world's second-largest economy, with the average rate expected to remain above the official target of 4 percent despite the numerous policy initiatives taken by the government.

The ADB's 2011 inflation estimate was revised up to 5.3 percent from 4.6 percent in April, largely because of a sharp spike in food prices.

Paul Heytens, country director of the ADB in China, said inflation had peaked in July and will fall in the next few months, and that the current figures look high because of the time lag between policy implementation and its effect.

The PBOC will maintain its anti-inflationary bias until it feels comfortable with the month-on-month momentum of CPI, said Chang Jian, a China economist with Barclays Bank Plc. "It needs to see a clear downward trend."

"On the other hand, in view of the expected slowing domestic economy, easing inflation and rapidly deteriorating external growth outlook, we expect no more interest rate hikes in 2011. We expect some 'selective' or 'targeted' easing in the months ahead, although we do not expect an official switch of the policy bias in the near term," said Chang.

A separate PBOC survey of bankers in approximately 3,000 institutions showed 56.4 percent foresee an increase in interest rates in the fourth quarter, down 11.8 percentage points from the survey in last quarter. Meanwhile, bankers' confidence in the health of the macroeconomy fell by 2.1 points to 54.9.

A separate survey showed that 50.6 percent of 5,000 entrepreneurs expect rates to be "relatively high" in the fourth quarter, 6.1 percentage points higher than in the previous quarterly survey.?

- Outstanding foreign debt climbs to $642.5b

- Standard for "high pure gold" set

- Vanishing property boom signals price decline

- China raises bar for fuel-saving car subsidies

- Huawei eyes enterprise deals

- China to curb chemical plants

- China extending pension program to countryside

- Fosun, PFI form insurance JV