AIA stays ahead with 'back to basics' plan

Updated: 2011-12-09 08:09

By Hu Yuanyuan (China Daily)

|

|||||||||||

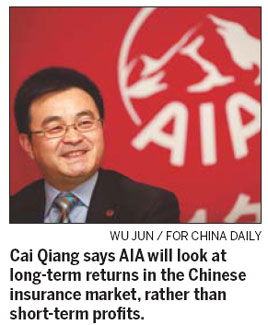

For Cai Qiang, chief executive officer of American International Assurance Co Ltd (China) - the first foreign insurer to venture into the country - it is time to go "back to basics" with a focus on sustainability.

Cai said the company will pay more attention to the demands of the domestic market and local customers rather than the single-minded pursuit of greater market share and short-term profits.

"AIA China will strive to make progress in terms of professionalism, productivity and profitability, and to help insured households and companies better deal with risks and accumulate their wealth," Cai said.

AIA Group became the largest life insurer in the Pan-Asia region through a separate listing in Hong Kong last October, raising about $20 billion.

Cai said that the group, now present in 145 markets across the Asia-Pacific region, took a lead in the industry in terms of life insurance premiums and has obtained a considerable share in most other areas.

In China, the group maintains a robust growth with its premium income surging by 17 percent from December 2010 to last May. The figures for annualized new premiums and the value of new business were 18 percent and 47 percent, according to AIA data released in July.

Cai attributed the unprecedented surge to the group's long-term focus on protective insurance products.

He is confident about the potential of the sector - "The domestic life insurance market is full of opportunities" - thanks to the relatively weak awareness of insurance among Chinese, limited coverage and categories of insurance, a quickly aging society and a high saving ratio.

However, Cai stressed the pressing need is to further consolidate the quality of services for customers.

"By seeking sustainability and adopting a 'back-to-basics' strategy, both Chinese and foreign insurers can achieve continuous growth," he said.

A decade since China joined the World Trade Organization (WTO), the annual growth in premium income in the life insurance market has been unprecedented, Cai said.

"Sales of insurance policies through banks shows an increasing proportion in marketing channels," Cai said.

In the highly competitive life insurance market, Cai said AIA strives to retain its edge by keeping its marketing team efficient and professional, investing in protective products R&D, diversifying marketing channels and finding more efficient operating models.

As for the decreasing market share of foreign insurers in the country's market since China's entry into the WTO, Cai blamed financial difficulties in some parent companies and differences between the cooperating firms.

"Financial difficulties in the parent companies of the foreign insurers affected their global strategy, while different opinions between foreign insurers and their Chinese partners affected the domestic performance," he said.

Cai added that the expansion of Chinese insurers outpaced their "slowly progressive and relatively conservative" foreign counterparts, rendering the latter's loss of market share "inevitable".

Chen Keyu contributed to this story.

Related Stories

AIA new business value up 53% in Q3 2011-10-15 06:39

AIA to stop taking fund orders for its IPO earlier 2010-10-19 10:48

China Life not keen on AIA stake buy 2010-08-27 09:30

China's Ping An, CIC eye stakes in AIA 2010-10-18 10:13

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%