Suspicion dampens inflows

Updated: 2011-12-09 08:10

By Chen Weihua (China Daily)

|

|||||||||||

|

Vice-Premier Wang Qishan and US Treasury Secretary Tim Geithner at a signing ceremony during the China-US Strategic and Economic Dialogue in Washington on May 10.[Photo / Reuters] |

Like the debate over whether China's rise is a threat to the US or whether the US strategy has always been to contain China, mistrust is also rife over Chinese foreign direct investment (FDI) in the US.

To calm Chinese concerns, US Vice-President Joe Biden opened his arms to Chinese investors during his visit to China in August.

"President Obama and I, we welcome, encourage and see nothing but positive benefit from direct investment in the US from Chinese businesses and Chinese entities. It means jobs," Biden told a business roundtable in Beijing.

Similar messages were also heard from US Secretary of State Hillary Clinton and other senior officials.

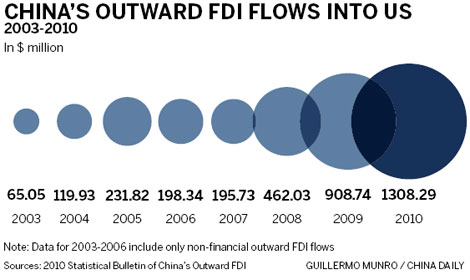

China's overseas direct investment (ODI), particularly in the US, has been a relatively recent phenomenon. The main topic in China when the country joined the World Trade Organization (WTO) in 2001 was about attracting FDI into the country, but the going-out strategy promoted by the government a few years later has encouraged Chinese firms to tap into the global market, technology and resources at a time when the country's foreign currency reserves have swollen to trillions of US dollars.

Chinese investment in the US is still smaller than that of countries such as the Republic of Korea and India. It also accounts for a small portion of China's total ODI.

But the fast growth has already drawn unprecedented attention and debate in the US, prompting many to compare China with Japan in the 1980s, when huge Japanese investment, especially the purchase of iconic US properties, triggered resentment among Americans.

While top US officials have welcomed Chinese investment, many Chinese still feel the US discriminates against Chinese investors.

Frequent comments made by US congressmen on Chinese investment and a few high-profile cases scrutinized by the Committee on Foreign Investment in the United States (CFIUS), an inter-agency that reviews foreign investments for national security concerns, have reinforced the perception that the process is biased against Chinese investors.

In August 2005, China National Offshore Oil Corporation (CNOOC) was forced to withdraw its $18.4 billion bid for Unocal under pressure from US congressmen, business interests and media.

In July last year, a bipartisan group of 50 lawmakers, citing national security concerns, requested that the US government probe an investment project of China's Anshan Iron and Steel Group to set up a joint venture with a US partner in Mississippi.

The experience of Huawei Technologies, China's largest telecom equipment maker, is often cited as a case of US discrimination.

Huawei's joint purchase in 2007 of 3Com was thwarted as US officials and congressmen believed the deal posed a national security threat.

In August 2010, eight US congressmen wrote to the Obama administration to scrutinize a deal between Huawei and Sprint Nextel on national security grounds. In February this year, Huawei had to withdraw its agreement to buy the assets of 3Leaf Systems under pressure from the CFIUS.

Chinese leaders also voiced their concerns. In a meeting with US President Barack Obama during a January visit to the US, President Hu Jintao expressed his hope that the US would provide a level playing field for Chinese investors.

During the Third Sino-US Strategic and Economic Dialogue in Washington in May, Minister of Commerce Chen Deming also called on the US government not to discriminate against direct investments from China. He described the US profiling and screening of Chinese investment proposals as "neither fair nor transparent".

Theodore Moran, a professor of international business and finance at the School of Foreign Service of Georgetown University, told China Daily that while there are legitimate national security concerns about Chinese investment in the US which CFIUS addresses, there are inappropriate US government interventions in some Chinese projects.

"You also have some emotional responses on the part of some congressmen. They don't have any specific evidence and just say things about investors from China, Russia and other countries. And then there are anti-Chinese campaigns that are orchestrated by competitors," said Moran.

Daniel Rosen, a principal at the Rhodium Group, a New York-based research firm, said CFIUS works well most of the time.

"The trouble often comes when politicians decide they want to say something publicly about the advisability of foreign investment in the US. It leads average Chinese to believe that the US talks about the free market and open trade and investment but it is just rhetoric. And this is unfortunate," said Rosen, who co-authored the special report American Open Door? - Maximizing the Benefits of Chinese Foreign Direct Investment.

The report, released in May by the Center on US-China Relations of the Asia Society and the Kissinger Institute on China and the United States at the Woodrow Wilson Center, advises the US to send a clear and bipartisan message that Chinese investment is welcome, the investment review process will be protected from interference, Chinese motives will be better understood and the promotion of FDI from China and elsewhere will be systemized.

Various reports show that Chinese FDI in the US has created some 4,000 to 10,000 jobs and has the potential to create more at a time when US unemployment hovers over 9 percent and creating jobs is the single most important topic for average Americans and US presidential candidates.

Analysts in both countries believe China and the US will lose enormous benefits if they cannot handle Chinese FDI in the US rationally.

"I totally believe that if we had more foreign direct investment from India and China, we wouldn't have as many issues as we have," Jeffrey Immelt, chairman and chief executive of General Electric, told a discussion at the President's Jobs and Competitiveness Council on Oct 7.

Related Stories

ODI makes dramatic rebound amid optimism 2011-09-21 08:03

More Chinese ODI urged 2011-09-08 09:11

Crisis creating ODI opportunities 2011-09-07 14:03

China eyes overseas markets 2011-09-07 13:25

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%