Saving the international monetary system

The internationalization of the renminbi will continue to help East Asian countries eliminate the negative influence of geopolitical factors

In the post-Bretton Woods era, there exists a fundamental contradiction between the dollar's status as a national currency (in serving US interests) and as an international reserve currency (in serving global interests). The United States must primarily provide international liquidity or reserve currency to the world through current trade deficits. In other words, the US provides the world with reserve currency by issuing "IOUs", and global economic growth requires the US to issue increasingly more "IOUs". The more "IOUs" are issued, the greater the US's external debt. When US debt accumulates to a certain amount, foreign investors and foreign central banks begin to doubt whether the US can redeem these "IOUs "with "real money". As a result, a balance of payments crisis may occur.

In the meantime, despite the rising ratio of US national debt to GDP and net foreign liabilities to GDP, the dollar remains stable because demand for the dollar as a reserve currency from other countries has also been increasing. The continuous growth of foreign exchange reserves held by other nations indicates their willingness to lend money to the US and finance its trade deficits. This way, the gap between domestic investment and savings in the US is filled by foreign savings, significantly alleviating inflationary pressures and the risk of dollar depreciation. Without the strong demand for US dollar reserves from other countries, a collapse of the dollar would have been inevitable long ago.

In the context of the growing sense of insecurity in the international environment, reform of the international monetary system seems to be an impending issue. After the outbreak of the global financial crisis, former president of the International Monetary Fund Christine Lagarde said at the China Development Forum that the reform of the international monetary system should focus on two aspects. First, ensure that the global financial safety net is large enough, coherent, and works for all. Second, strengthen global cooperation on issues and policies affecting global stability. I have no objection to the second point. However, my question regarding the first point is: how large must this safety net be to be considered sufficiently large? Regardless of how much foreign exchange reserves it holds, it will never be enough. Even $1 trillion in foreign exchange reserves could be quickly depleted.

The challenge facing the IMF is not merely ensuring that the global financial safety net is large enough, but rather finding ways to reduce the necessity for countries that issue non-international reserve currencies to accumulate reserve assets. In other words, it involves reforming the dollar-centered international monetary system.

From the perspective of international financial relations, a longstanding unresolved issue is the global imbalance that was heatedly debated around 2006, when the US' net foreign liabilities stood at $1.8 trillion, approximately 13 percent of the country's GDP. By 2022, this figure had risen to $18 trillion, accounting for 70 percent of its GDP. At that time, there were concerns that a sudden halt in foreign capital inflows into the US could lead to a depreciation of the dollar, US debit defaults, or actual defaults triggered by inflation. Considering the present situation, shouldn't we be even more concerned about the impact of the US' net foreign liabilities on international financial stability?

Former chair of the board of governors of the US Federal Reserve, Ben Bernanke, blamed the excess savings of trade surplus countries as the reason for causing global imbalances. In fact, a more significant cause of global imbalances is the insufficient savings of the US, specifically its massive fiscal deficit. In 2020, the US fiscal deficit reached 14.9 percent of its GDP.Consequently, former US treasury secretary Lawrence Summers referred to the country's fiscal policy as "the most irresponsible policy". According to IMF data, in 2023, the US experienced a "substantial fiscal deterioration", with the deficit-to-GDP ratio reaching 8.8 percent, more than double of the figure in 2022. On Dec 29, 2023, the US Treasury's daily report indicated that federal government debt surpassed $34 trillion. As IMF Chief Economist Pierre-Olivier Gourinchas said, the US fiscal stance is "of particular concern", and "it raises longer-term fiscal and financial stability risks for the global economy".

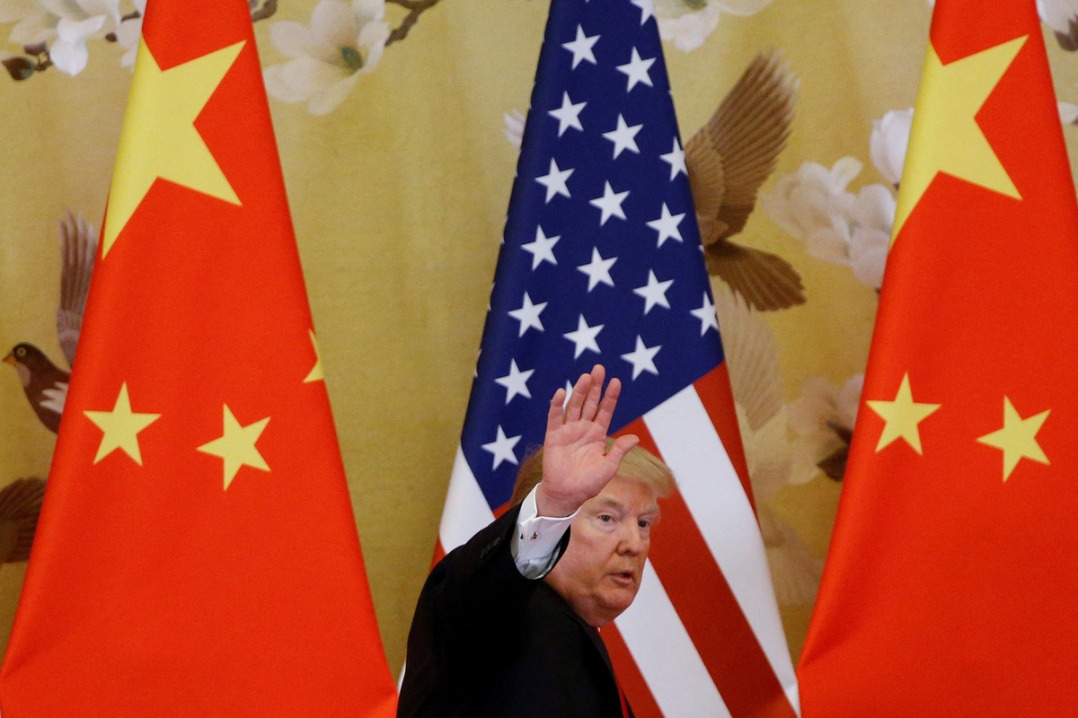

If, say, we have long been concerned that the continuous increase in US net foreign liabilities would ultimately lead to a so-called sudden stop, default on US treasury bonds, depreciation of the dollar, and a sharp worsening of US inflation, now a new dimension of threats has emerged for other non-allied countries of the US. Due to geopolitical needs, the US may seize China's overseas assets. As early as 2013, Financial Times columnist Martin Wolf pointed out that in the event of a conflict, the US could well freeze China's foreign exchange assets. Although both parties would suffer substantial losses, China's losses would be even more severe. Wolf's warning has proven to be not merely alarmist. Following the outbreak of the Russia-Ukraine crisis, the US froze $300 billion of the Russian Central Bank's foreign exchange reserves within 72 hours. Who can be confident that the US will not freeze the foreign exchange reserves of other countries in the future? The weaponization of finance or the US dollar represents a fundamental disruption of international financial rules.

The direction for reforming the international monetary system through global or regional coordinated efforts has become increasingly uncertain. The process of fragmentation in the international monetary system may have already begun. For example, during the 2008 global financial crisis, the bilateral currency swap agreements among the US Federal Reserve, Bank of England, Bank of Canada, Bank of Japan, European Central Bank and Swiss National Bank were very effective in lowering interest rates and avoiding liquidity freezes. However, these currency swaps were conducted without collaboration with the IMF. Despite the positive role of the six central banks' currency swaps, it is also undeniable that they have increased the fragmentation of the global financial safety net. After Western countries froze Russia's foreign reserves, former Reserve Bank of India governor Raghuram Rajan pointed out that SWIFT is an integral component of the global monetary system. Once SWIFT is weaponized, some relatively close countries may wonder if they can create a settlement system among themselves. In this case, from the perspective of the settlement system, the global monetary system is indeed fragmented. The outlook for the global monetary system is similarly concerning.

The process of fragmentation in the international monetary system will further develop, and the possibility of forming monetary blocs based on economic and geopolitical foundations cannot be ruled out. In the face of this potential trend, China's position is clear: China will further promote the strategic adjustment of "dual circulation, with domestic circulation as the mainstay". It will improve the balance of international payments, improve the exchange rate formation mechanism, fulfill commitments to liberalize the financial services industry, and orderly open the capital account for the free convertibility of the renminbi while effectively managing cross-border capital flows. The internationalization of the renminbi will continue to advance. China will continue to work to uphold the authority of the IMF and other multilateral international organizations, adhere to the established rules of the IMF and the Bank for International Settlements, and promote various forms of inter-state financial cooperation. Meanwhile, East Asian countries should eliminate the influence of geopolitical factors and restart regional financial cooperation.

The author is academic member of the Chinese Academy of Social Sciences. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn.